Calculator

Investor Risk Profile

The major purpose of this investigation is to determine your level of risk tolerance. “Risk” in the financial services context simply means the possibility, if not probability, that an expected investment outcome may not be achieved.

Himalayan Capital Limited has devised a set of questions in order to capture following information essential to properly determine your Risk Profile:

- Your time horizon;

- Your objectives and requirements in relation to capital security, income and capital growth;

- Your investment experience and preference;

Remember that this risk profile represents a starting point for you. Your experience with investing, living through investment volatility and changing goals may mean that your risk tolerance evolves over time. Because of this, it is important to regularly review your risk profile to make sure that it is still right for you.

SECTION 1: EDUCATION

Risk

In investment, risk can be defined as possibility of losing some or all of an original investment.It often refers to the chance an outcome or investment's actual gains will differ from an expected outcome or return.

To some people, risk may represent an opportunity to accumulate wealth faster. Whilst risky assets can drop in value, they can also offer a greater increase in the value of your money. For example, funds parked in Fixed Deposit or Debentures entail zero risk. However, return derived from such investment is also very minimal. Whereas, investment in shares generally entail certain risk due to fluctuations. However, investment in these assets generally provide premium returns for the risk undertaken.

So to different people, risk can be a positive or negative thing. Part of this process is to find out what risk means to you.

Volatility

In the securities markets, volatility often refers to the amount of uncertainty or risk related to the size of changes in a security's value. A higher volatility means that a security's value can potentially be spread out over a larger range of values.

This means that the price of the security can change dramatically over a short time period in either direction. A lower volatility means that a security's value does not fluctuate dramatically, and tends to be more steady.

Although this volatility can present significant investment risk, when correctly harnessed, it can also generate solid returns for shrewd investors.

Asset allocation

Asset allocation is an investment strategy that aims to balance risk and reward by apportioning a portfolio's assets according to an individual's goals, risk tolerance and investment horizon. The three main asset classes - equities, fixed-income, and cash and equivalents - have different levels of risk and return, so each will behave differently over time.

An asset allocation strategy is designed to control your portfolio's long-term makeup. It should not change based on economic conditions or market fluctuations. Over time, your asset allocation might change based on changes in your financial situation, your age, and progress toward your financial goals.

Since, investments with higher returns typically have higher risk and more volatility in year-to-year returns, asset allocation combines more aggressive investments with less aggressive ones. This combination can help reduce your portfolio's overall risk.

Diversification

Diversification is the way of minimizing the impact of volatility is to hold your investments for a long period of time, as the fluctuations are smoothed out over time.

The more ways you diversify, the more you can potentially reduce your risk. For example, you can invest:

- Across different asset classes (e.g. cash, fixed interest, property and shares)

- In more than one investment within each type (e.g. invest in several different sectors and companies when investing in shares)

Diversification strives to smooth out unsystematic risk events in a portfolio, so the positive performance of some investments neutralizes the negative performance of others. The benefits of diversification hold only if the securities in the portfolio are not perfectly correlated—that is, they respond differently, often in opposing ways, to market influences.

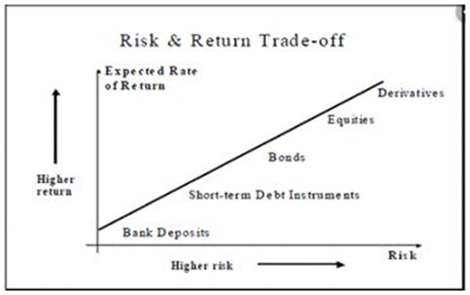

Risk vs. Return - The trade off

There is a reason that investors may choose to invest in products from higher risk asset classes instead of investing in low risk, highly stable asset classes: higher the risk, higher the return. This is known as the risk-return trade off.

It is important to think about how much risk you are willing to take on in your investments to achieve your desired level of return. Should you require stability and security in your investments, you should probably keep your money mostly in investments such as cash and fixed interest, to reduce the risk of losing money. Likewise, should you have time on your side and no need to access your money for more than ten years, and you are comfortable with fluctuations in the value of your investment, you should have a larger exposure to shares and property. Over the long term, you will likely be rewarded with a higher capital value, than if you left your money in the bank.

You should also be aware of the effects of inflation on cash investments. Inflation (rise in the prices of goods and services) erodes the value of your savings or money in the bank. For example, if you are earning 5% p.a. interest in the bank and inflation is at 3% p.a., you are really only earning 2% p.a. when the real purchasing power of these funds are considered.